10-Year Treasury Yields Reach All-Time Low

With treasury yields plummeting, how can an investor take advantage of the current state of the economy? As opportunities dwindle for purchasers of treasury bonds, savvy investors are turning to the mortgage market.

You have probably heard that 10-year treasury yields have reached an all-time low, dropping below 1% for the first time in history. You may be asking, what does that mean and why is it significant? Well, simply put, it means that globally, investors are willing to commit their money for ten years in exchange for a measly 1% return on their money. The overarching fear surrounding global growth in the near future has driven investors towards bonds and other relatively low-risk investment classes, causing yields to drop. In other words, investors are willing to sacrifice yield in favor of safety in a high volatility securities environment.

So what caused this record-breaking dip in treasury yields?

The first factor is actually the recent Coronavirus outbreak and it’s effect on the confidence levels of the American people. The public perception at this point is that the immediate future of the global economy is very much in flux. As the virus begins to appear and spread in the US, so too does an accompanying sense of uncertainty. Also contributing to the falling rates, the Fed has lowered the benchmark interest rate to just below 1.25%. This enables banks to lend at lower rates to consumers interested in borrowing money for a home purchase or refinance.

How does this impact you as a current or aspiring real estate investor?

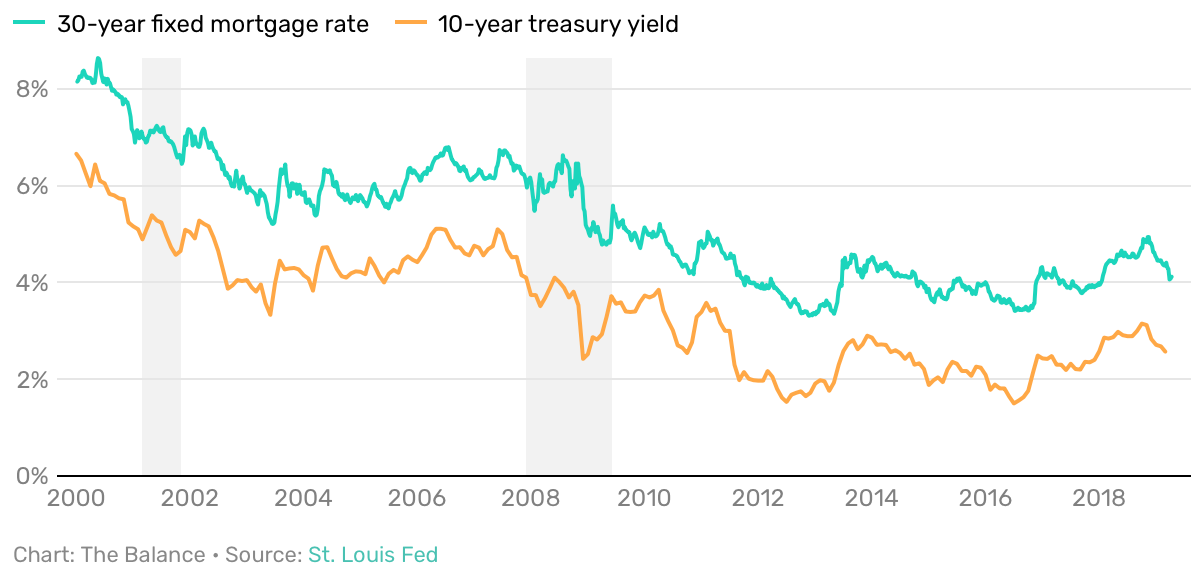

The good news for you is that the 10-year treasury yield is closely tracked by 30-year fixed mortgage rates. Investors seeking a relatively safe return will shop interest rates of various asset classes that compete in the categories of overall risk and stability. In this case, the most notable market being fixed rate mortgages. This means that as treasury yield rates fall, mortgage rates will follow closely behind, leaving opportunity zones for savvy investors and home buyers.