Saving for the Future: Why and How to Transform Your Finances

Saving money helps improve your financial security and freedom. Here’s how you can start saving for the future in a meaningful way.

The importance of saving for the future is undebatable. These days, few people have pensions from their workplaces, and the average social security check is only around $1,500 per month. Therefore, households must take steps on their own to save for the future — through retirement funds, real estate, or other assets.

Unfortunately, many Americans are falling behind on saving for the future. Around 25% of Americans have nothing saved for retirement, and the average American household has just $65,000 in their retirement accounts.

This guide will go over what you need to know about saving money for the future. It will cover what financial goals to prioritize, as well as actionable tips on how to achieve your savings goals.

The importance of saving for the future

Recent data shows that 64% of Americans now live paycheck-to-paycheck. At its most basic level, saving for the future allows you to break free from the paycheck-to-paycheck cycle that keeps so many Americans trapped.

Saving for the future offers dozens of benefits. Some of the most important include:

- Flexibility to handle unexpected expenses

- The funds to enjoy a comfortable retirement

- The funds to buy a home, a second home, or an investment property

- The ability to earn passive income

- Financial security

- Lowered financial anxiety and worry

- Greater peace of mind

Saving for the future also gives you options. Maybe you want to take a risk and switch careers or take a year off to travel the world. Maybe you want to have children and have one parent stay at home full-time. Having wealth allows you to consider these options seriously.

And one of the most obvious benefits is the ability to retire and enjoy your golden years. If you don’t save for retirement, you will likely have to work much longer than you would like to.

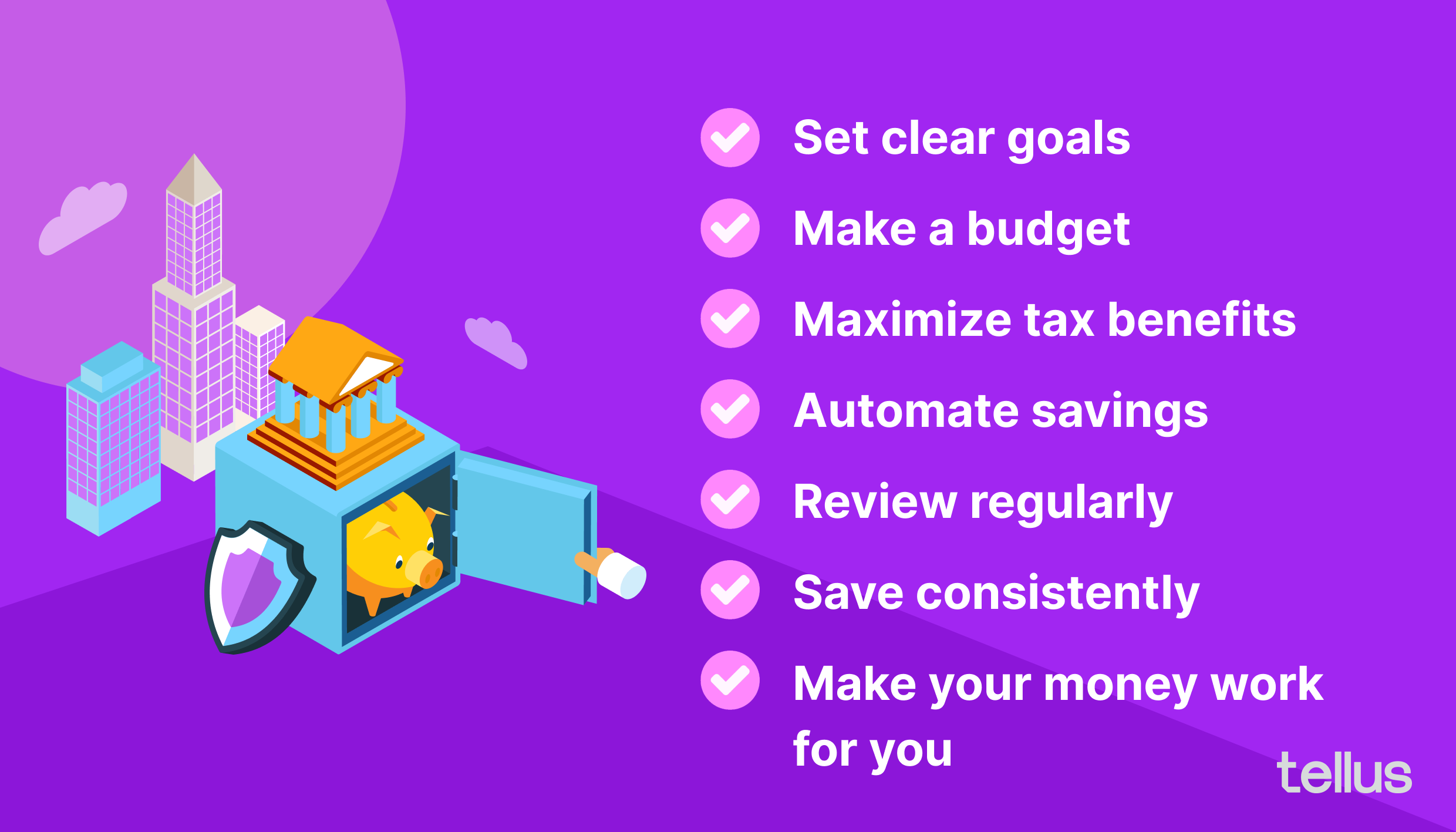

How to save money for the future

There are dozens of valid reasons to start saving money for the future. But what are the best ways to go about it?

It starts with establishing what you’re saving for and why. You can gain more insight and motivation by clarifying your reasons for saving.

Ideally, go beyond the basics and dig a little deeper. Instead of saying, “I will save for retirement so that I can retire by 65,” say, “I will save for retirement so that I can retire and travel the world with my partner.”

This kind of thinking can help you feel more inspired to work toward your goals. It can make saving feel less like a chore and more like a worthwhile task in pursuit of your goals and life values.

Beyond this shift in thinking, here are actionable strategies you can use to save for the future.

Set clear goals

Setting goals is vital. The more specific you can be, the better.

It’s wise to use the SMART goals framework. SMART stands for specific, measurable, achievable, relevant, and time-bound.

An example of a SMART goal might be:

- I will save $60,000 for a down payment by [target date]. To achieve this, I will deposit [target dollar amount] per month into my savings account. I will monitor my progress yearly to ensure I stay on track.

An example of a goal that’s not SMART might be:

- I will save money each month toward a down payment.

As you can see, the SMART goal is much more specific and actionable. The second goal example is far too vague and isn’t measurable at all.

Make a budget

If you already use a budget, you can adjust it to work toward your savings goals. For example, you may choose to reduce your spending on dining out to allocate more toward savings.

If you don’t yet budget, it’s a good idea to start. Our how to budget guide is a great starting point.

Utilizing a budget can help you monitor your spending and set clear intentions for how your spending aligns with your goals and values.

Maximize tax benefits

Maximizing any available tax benefits can help you build more wealth without necessarily saving any more money. In other words, by reducing your tax bill each year, you can build wealth faster.

Maximizing your contributions to tax-advantaged retirement plans is the primary way to save on taxes. Contributing to your 401(k) or IRA accounts can earn you valuable tax breaks in the current year and/or tax benefits in the future.

For example, if you’re in the 22% tax bracket, making a $5,000 contribution to your 401(k) would earn you a tax break worth approximately $1,100. Plus, if your employer matches 401(k) contributions, the net benefit could be even greater.

That $1,100 in tax savings could then be used to make additional retirement contributions or save toward your various other goals. Over time, this effect can be dramatic.

To illustrate, consider this example:

- You make a $5,000 annual 401(k) contribution and are in the 22% tax bracket

- This earns you a tax break of approximately $1,100 each year

- You invest this $1,100 each year into stock market index funds, earning 7% per year on average

- After 30 years, you could have an additional $112,280 in savings

In this example, you wind up with $112,280 in additional savings purely from the tax benefits of contributing to retirement accounts.

Automate savings

The more you can automate your savings strategy, the more likely you will be to reach your goals. By automating your savings, you can essentially automate your progress toward your goals.

Most banks and fintechs allow you to set up automatic transfers. This could mean transferring funds from checking to savings or transferring from your bank account to your investment account.

This is also a way to prioritize savings over spending. For example, if you set your savings transfers to take place the day after your paycheck is deposited, you’ll simply have less money in your checking account to spend.

Review regularly

Tracking your progress routinely can help you stay on track. It’s wise to check in at least once every six months.

You can build a spreadsheet to track your goals or use the old pen-and-paper technique. If you notice that you’re falling behind, make adjustments as needed.

Save consistently

Consistency is the key to success when it comes to saving. Even small amounts of money can really add up over time.

For example, $50 per month seems insignificant — but over a 10-year period of time, that’s an extra $6,000!

Make your money work for you

Finally, it’s important to utilize the savings you already have to accelerate your progress.

When your money earns interest, it grows automatically. $1 invested today, earning 7% returns, will turn into $7.61 after 30 years.

For long-term savings, like retirement, it’s best to invest your money in high-growth assets like stocks. Over the long term, the US stock market has returned around 10% per year, on average.

The simplest way to invest in stocks is to buy diversified index funds. Stock market index funds allow you to purchase hundreds or even thousands of companies all at once. S&P 500 index funds are a popular choice, which invest in 500 of the largest companies in America.

For shorter-term savings, it’s best to avoid stocks. This is because the stock market fluctuates frequently, and it’s impossible to predict its short-term movements. If you invest short-term savings, you may be forced to sell at a loss when it comes time to utilize your savings.

But you still want to be sure you earn a return on your savings! Do not let your savings idle in an account that earns next to nothing–– especially with inflation eroding the value of your money at 8.25%.

Financial goals to prioritize

It’s important to have goals. Saving with a goal in mind can help keep you motivated and on track. But if you have many different savings goals, it’s also important to know what to prioritize.

Generally speaking, retirement should be a top priority – but it’s not the only financial priority to consider.

Retirement

Retirement is a huge goal to save for, and the earlier you can start, the better. For this reason, it should be a top priority for most households.

Because of the effects of compounding interest, invested savings grow faster and faster over time. Compounding interest is the interest you earn on the interest that has already accrued. In other words, you start earning interest on the amount you originally invested, plus the amount of interest you have already earned. This can create a snowball effect that accelerates over time.

If you save $200 per month for 45 years and earn 7% returns, you’ll end up with around $711,000. But if you save $200 per month for 35 years, you’ll end up with around $344,000. To achieve the same end result in a 35-year period, you would have to save more than twice as much – or around $414 – per month.

Plus, retirement accounts offer generous tax perks which can help accelerate your savings. Many employers even match contributions to 401(k) accounts, further boosting your progress.

Determining how much you need to save for retirement is a tricky process with a lot of moving parts. It’s best to work with a financial advisor to determine your goals and come up with a plan.

Emergencies

It’s important to be prepared for emergencies. Unexpected events like car trouble, major home repairs, and health concerns can quickly add up to thousands of dollars. If you aren’t prepared for these expenses, you can wind up going into debt.

Emergency funds also provide a stopgap in the case of an unexpected loss of income. If you or your partner lose a job, for example, your financial situation can be drastically thrown off.

For this reason, it’s important to have an emergency fund. Most experts recommend that you have between 3 and 6 months' worth of expenses saved in your emergency fund. If your household spends $5,000 per month, that’s $15,000 to $30,000 that you ideally should have set aside for emergencies.

Be sure to keep this fund in liquid savings that are easily accessible. Emergency funds should not be invested in vehicles like stocks or bonds, as you want to be able to access your money at any time.

Homeownership

Homeownership is a life goal for many people, and it’s a financial goal well worth prioritizing.

Owning your own home can help you grow your wealth, as real estate tends to increase in value over time. Plus, you’ll have the eventual benefit of reduced expenses once your mortgage is paid off.

Saving for homeownership is mostly about saving up for a down payment. Most loans require a bare minimum of 5% of the home value – or $25,000 on a $500,000 home. However, a common goal is to save up for a 20% down payment – or $100,000 on a $500,000 home.

Wrapping up

Saving for the future involves setting clear goals, making a plan to meet those goals, and then consistently working toward achieving those goals. There are more advanced strategies to use (like taking advantage of tax savings), but in the end, consistency is the secret to success when it comes to personal finances.

Finally, if you have some money saved, make sure it’s working for you! Use Tellus to earn 3.00% to 4.50% APY. Learn more about how Tellus works here.