Weekly Savings Plan

Here’s how to create a weekly savings plan that’s actionable and practical.

There are three key reasons you should be saving: major purchases, emergencies, and retirement. Weekly savings plans tend to be better than monthly savings plans, as they are easier to stick to and generate more interest. Getting started on a weekly savings plan can be done in four steps.

Everyone should be saving more — most people can agree on that. The biggest questions people hoping to boost their savings have are: how much should I be saving, and how do I get started with a savings plan?

Saving money is easier than many expect. One of the easiest ways to get started is with a weekly savings plan. Sure, there are unexpected expenses or temptations to use our savings for other things. However, a little discipline — along with some easy money management tips — can go a long way in getting a weekly savings plan in place and ensuring it sticks.

In this article, we’ll explore the key reasons you should be saving, why we often find excuses not to save, the major challenges you’ll face when saving, and ultimately why a weekly savings plan is a must-utilize tool for your financial journey.

Contents

Why you should be saving money

Most people are familiar with the main reason you should be saving — to ensure you’re prepared for both short and long-term financial needs. These needs might include major purchases, putting your kids through college, or retiring without any financial burden.

Of course, having a proper savings plan can improve your life well before you retire. Savings plans — notably weekly savings plans — can greatly reduce your financial stress and improve your quality of life. Below we outline the three savings buckets you should have.

1. Emergencies

An emergency fund is necessary for navigating the unexpected. Things happen — cars break down, layoffs happen, medical emergencies come up, etc.

Say you need a major car repair. If you get caught without an emergency fund, you may have to use a credit card to cover the expense.

If the repair is $3,000 and the interest rate on the card is 23% you’ll need to pay over $282 per month to get the card paid off in a year. Alternatively, you could have been proactive and saved $58 a week over the last year to build your emergency fund, which would’ve covered the repair and saved you over $386 in interest paid to the credit card company.

A good rule of thumb is that an emergency fund should cover roughly three months of your expenses. However, this will vary based on your situation. If you’re just getting started with your savings journey, it’s advised that you start by building an emergency fund as your first priority.

2. Major purchases

Saving for big purchases is something that can get overlooked. An emergency fund will cover you for the unexpected, whereas a savings plan for major purchases will cover you for the expected.

Most people have similar major annual purchases or expenses that they need to save for during a year — holiday spending, vacations, home repairs, etc. Many also have longer-term expenses, such as buying a new car, making a down payment on a home, or paying for education. Having the necessary money saved for these purchases will help you avoid getting into a situation where you have to pay a large amount of interest for financing.

3. Retirement

Retirement is probably the most well-known reason to save. What’s convenient is that many companies offer 401(k) pension accounts. If you contribute to your 401(k) and are paid weekly, then you already have a weekly savings plan for your retirement. However, if you don’t have a 401(k), you can still fund your individual retirement account (IRA) on a weekly basis.

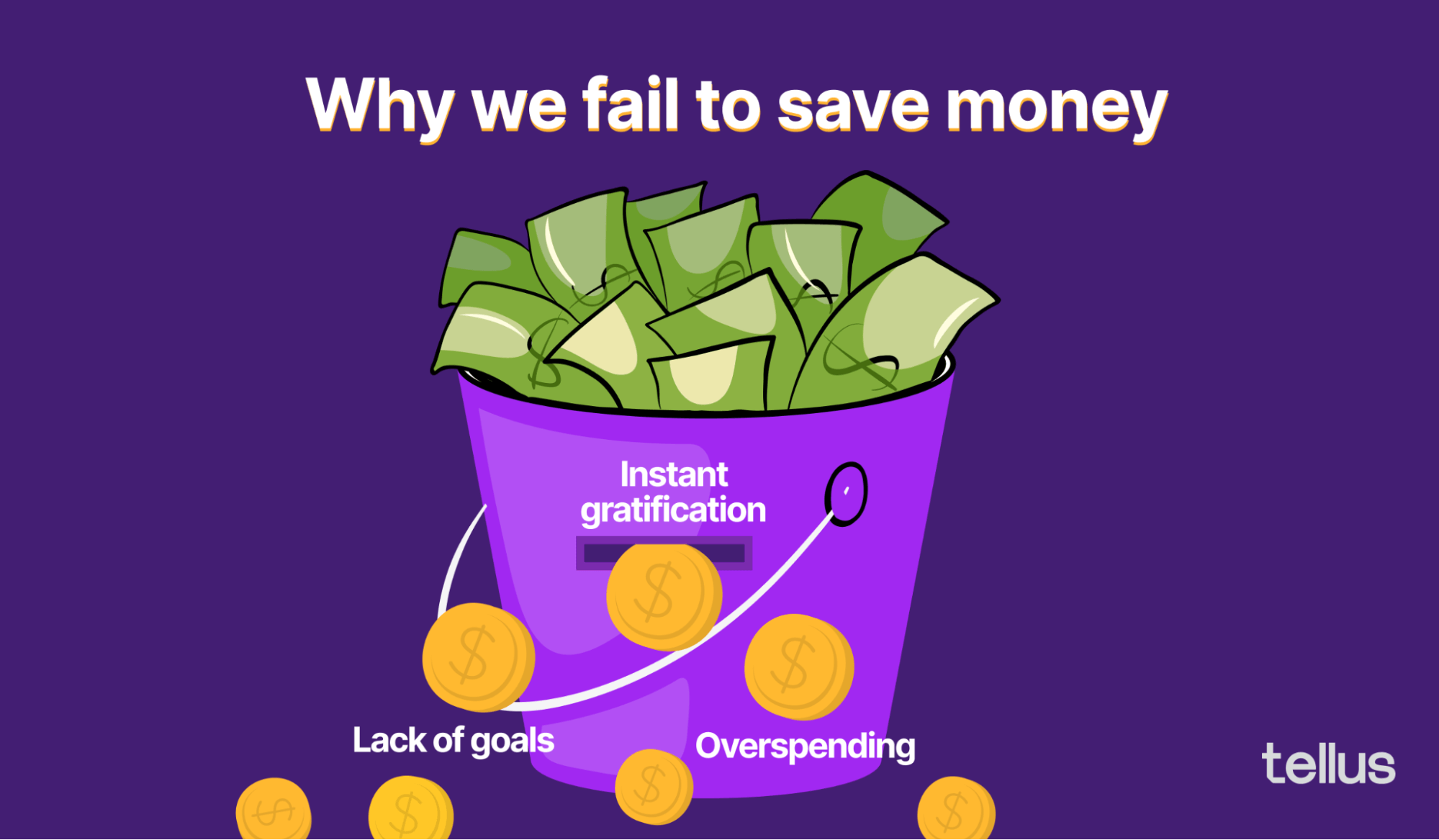

How to avoid common savings hurdles

Saving money seems difficult with the many financial priorities we all have — not to mention the temptation to spend. However, by just understanding some of the major challenges that keep us from creating a savings plan, we can overcome them.

Instant gratification

Putting money aside for the future means sacrificing access to some of it now, which can be challenging. It’s easier than ever to spend money, especially with the rise of online shopping and the convenience of using your phone.

To avoid this, pay yourself first — that is, align your savings transfer with your payday. Set up a direct transfer from your checking account so that as soon as your wages go in, a portion of them are sent directly to your savings account.

You can either pay yourself now and get a return on your money or have to seek out financing and end up getting farther behind on savings goals due to interest payments on credit cards or loans.

Overspending

Living beyond our means often leads to coming up short in savings. The easiest way to combat that is with a budget that works — that is, a budget that you can stick to but that also leaves room to save. Budgeting can mean short-term sacrifices, such as reducing the number of streaming services you pay for, but your future self will thank you.

Lack of savings goals

It might seem simple, but one of the major reasons that people often fail to save is that they simply don’t set a savings goal.

And, according to MoneyHelper (formerly National Savings and Investments), people with a savings goal save faster and up to £550 a year more than people who don’t. So, it’s important to have savings goals.

Saving for something in the future seems daunting, but it doesn’t have to be — especially if you tackle it in small increments. Start small, build momentum, and you’ll be surprised with how easy it can be — hence the benefits of a weekly savings plan.

Benefits of weekly savings plans

So we’ve covered why you should be saving and some of the key challenges associated with it. But why a weekly saving plan? Why not a monthly one or even just squirreling away some money every time you have a little spare cash? What’s so special about saving weekly?

Here are three key reasons to choose a weekly savings plan:

1. It’s more manageable

A weekly savings plan is easier to get started with — and stick to. Say you know you’ll need $6,000 in a year’s time to cover a big purchase. If you’re told that’ll be $500 a month, that might be too overwhelming to tackle. Yet, $116 a week will likely seem a bit more manageable, and it will still get you to your $6,000 goal.

And if you haven’t set up an automatic transfer, manually transferring $500 feels more painful than $116. Which leaves plenty of opportunity to make excuses to delay the transfer or only send a portion of what you planned in setting your savings goal.

2. It works with your weekly budget setting

Setting a weekly budget can feel easier to stick to than portioning out your money on a monthly basis. As you plan your budget for the week, simply immediately allocate a portion of your funds for your saving pot. This works especially well if you get paid weekly. Once you’ve topped up your savings, you know that whatever you have left you’re free to spend, which lets you tick off some of those instant gratification purchases.

3. It earns more interest

The final reason to put money into a savings vehicle weekly is compounding. The sooner you can get your money into a savings account, the sooner it’ll start earning interest.

Benjamin Franklin once said of compounding, “Money makes money. And the money that money makes, makes money.” Getting your money into your savings account sooner means you’ll start earning a return sooner — put simply, you’ll earn more money.

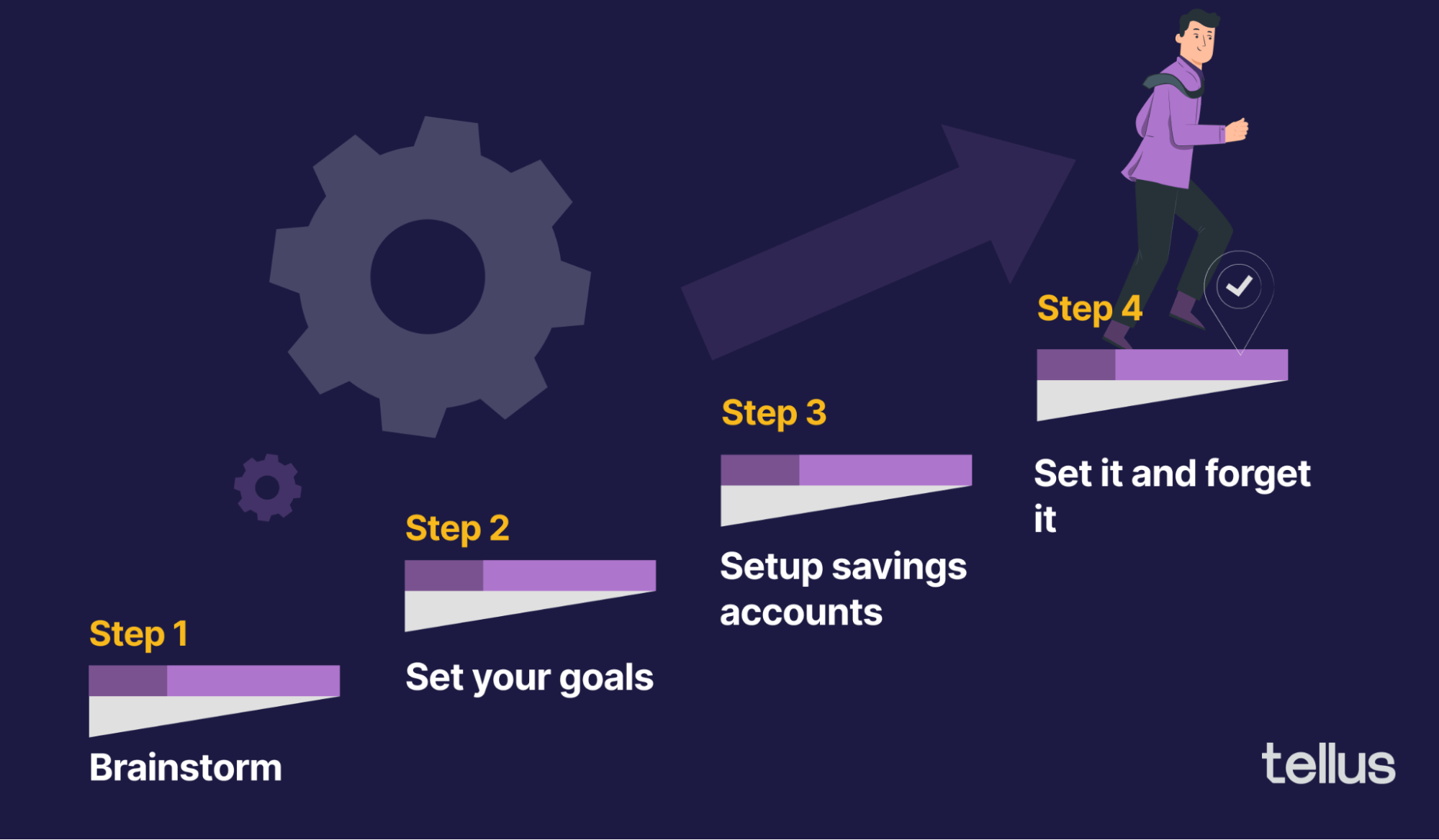

The 4-step weekly savings plan

Setting up an achievable weekly savings plan is a great way to start saving money. Here’s how to do it in 4 steps.

1. Brainstorm

Think of every major expense over a key threshold ($2,000, for example) that you’ll need to spend money on in the next few years. What are your key reasons for saving? It’s as simple as figuring out what you’re saving for and why.

2. Set goals

In Step 2, you’ll figure out your savings goals. This means turning the expenses and needs you came up with in Step 1 into actionable items. It’s easiest to start at the end and work backwards.

For example, once you figure out how much you’ll need for each goal, figure out what you need to be putting away weekly. A goal-oriented savings plan will be much more effective than just seeing how much money you are left with at the end of a period and setting that aside.

Try figuring out the total weekly amount you need to be saving and make your budget work around what’s left — this is known as “paying yourself first.”

3. Lay the groundwork

Step 3 is putting everything in place. There are many ways to save and accounts to choose from. This is where you decide which savings accounts or vehicles are best for each goal. It’s a good idea to make a weekly savings plan for each goal you have. For example, you will have a separate savings account or savings vehicle (money market account, certificate of deposit, savings bonds, etc.) for each savings goal.

4. Automate

This is where you put things on autopilot. Set up your accounts and put automatic transfers in place. It’s also a good idea to set up your savings accounts outside of your main bank. That way, you won’t even see the balance when you log in to your checking account for other things.

After you “set it and forget it,” it’s okay to make adjustments as needed. Most importantly, if you get a raise, find a higher-paying job, or establish a side hustle, make sure you increase your savings rate. If you get a 10% raise, it’s good practice to boost your savings across all your weekly savings plans by 10%.

Weekly savings plan example

One of the simplest and most used weekly savings plans is the 52-week savings plan — also known as the 52-week savings challenge. With this plan, make weekly deposits into a savings account for one year, increasing the amount by $1 each week.

For example, at the end of Week 1, you’d deposit $1 into your savings account. For Week 2, you’d deposit $2, and this would continue until you reach Week 52, when your deposit would be $52.

At the end of the year, you would have saved $1,378 using this plan. This plan is great for helping you build an emergency fund or save for a major purchase, such as a vacation. The method of increasing your weekly deposit is a great way to build momentum. You can think of it as a snowball effect — get something small going, and build momentum more easily over time.

How to stick to your savings plan

The personal saving rate (the percentage of disposable income that individuals are saving) is in decline. It is currently at 3.5% — the lowest in over a decade. However, boosting your savings rate is possible, regardless of your income level or personal situation. Setting a weekly savings goal and sticking to it comes down to two things: goals and budgets.

Get savvy with goal setting

Sticking to your savings plan means planning for hurdles you might face. To start, make sure your goals are realistic. Be aggressive but realistic with how much you can put away. If you need to generate additional income to meet your savings goals, plan ahead.

To keep the momentum, make sure you celebrate when you meet certain savings goals — such as saving the first $1,000 of a car deposit or building up your emergency fund.

Budgeting 101

When you create your weekly savings plan, you’ll need to account for your outgoings to work out what you can expect to save. Your savings goals will become obsolete if you don’t make reasonable assumptions about what you’ll spend.

Things don’t have to be complicated here, either. Make a list of all your current expenses, and figure out which ones aren’t necessary. There are services that will negotiate on your behalf for lower phone bills, for instance. Other services will categorize all your expenses and tell you how much money you’re spending in certain categories — such as food and entertainment. With this knowledge, you can plan your spending to a reasonable level of confidence.

A note about debt

Yes, you should be saving, but if you have higher-interest debt, getting rid of that should be the focus. You’ll get a return on your savings, but it’ll pale in comparison if you’re paying 20%+ in interest on credit cards and other loans.

That’s not to say you can’t save and paying down debt at the same time, however — especially if you’re still building an emergency fund. It’s just that the majority should be put toward debts. And don’t forget to consider ways of reducing your debt. You could consider consolidating your debt or transferring the balance of a high-interest credit card to a lower-interest card.

Conclusion

By working through the steps above, you can create an actionable weekly savings plan. Simple money goals work best for 99% of people. The biggest thing with making personal finance goals work is to make achieving them as easy as possible.