What are liquid assets?

Need access to cash? Check out this guide to find out how you can build your liquidity.

We’re living in some pretty turbulent times where money is concerned.

Living costs are shooting up, inflation is rising, and wages aren’t necessarily keeping pace with those rising costs. As a result, it’s absolutely critical you have something to fall back on in case of an emergency.

That’s where liquid assets come in.

Liquid assets are the cash or cash equivalents you can spend at the drop of a hat if you ever need to. There is a pretty wide range of liquid assets you can invest in, and each type goes hand-in-hand with its own set of pros and cons.

But if you’re new to liquidity, don’t stress. We’re here to help.

This guide explains what liquid assets are, the types of assets that count as liquid, how liquid assets are different from non-liquid assets, and how you can invest in and store liquid assets.

What are liquid assets?

Before we speed right into how you can invest in liquid assets, let’s pump the brakes and talk about what liquid assets actually are.

A liquid asset is cash that you have on hand or an asset that you can easily convert into cash. Those assets are often referred to as “cash equivalents” because they can be sold or exchanged for cash so quickly that it’s practically like the real thing.

To qualify as a liquid asset, a cash equivalent needs to be in an established, liquid market with a number of readily available buyers. Ownership transfers have to be easy to facilitate. They must also be totally secure — and it’s worth noting that the amount of time to cash conversion can vary depending on the asset type or market.

Liquidity can apply to your personal and company finances. Companies that own assets will normally consider anything they’re expecting to convert into cash within 12 months as a liquid asset. All of a company’s liquid assets will form what accountants call its “current assets,” which also includes things like inventory and accounts receivable.

Why are liquid assets important?

In terms of your personal finances, having access to liquidity is incredibly important in case you run into a financial emergency.

Think about it: if your boiler breaks down, you run into a huge medical emergency, or your car gets totaled, you’re not exactly going to have time to auction off your family heirlooms or get your house onto the market to address the emergency at hand.

When life comes knocking, it doesn’t matter whether you’re living on the breadline or a billionaire. You’re going to need quick access to liquid cash so that you can pay for the crisis at hand while still staying on top of all your other household bills and keeping afloat.

Unfortunately, the numbers say most of us aren’t prepared for these kinds of expenses. Less than half of US adults say they don’t have a rainy day fund, while around one in five admit to spending more than they’re earning.

You don’t want to be one of those statistics. That’s why liquidity is important to individuals and families.

From a corporate point of view, companies need to maintain certain levels of liquidity to meet short-term obligations. Short-term obligations are any liability that a company will need to pay out within a year and can only be dealt with using liquid assets.

Company accountants and treasurers will normally measure liquidity using a quick ratio. The quick ratio compares all of a company’s liquid assets to its current liabilities — and a low quick ratio tells a company that it might run into a problem meeting all of its debts in the short term. Likewise, a high quick ratio might indicate a company is holding on to too many liquid assets.

Liquid assets vs. illiquid assets: what’s the difference?

We’ve already briefly covered how liquid assets work, but it’s definitely worth taking a deep dive into how these assets are different from illiquid assets (or “non-liquid assets”).

First, let’s take a look at the factors that dictate whether something is a liquid asset — and, more importantly, what counts as a cash equivalent.

What qualifies as a liquid asset?

Simply put, liquid assets are either cash or something that can be turned into cash at the drop of a hat. The latter are your cash equivalents.

But to qualify as a cash equivalent, your asset has to be part of an established market (like a stock market or a mainstream cryptocurrency). It also needs to have a large number of interested buyers, and it has to be fairly simple to transfer ownership of the asset to a buyer after you’ve sold it.

Most importantly, your cash equivalent asset should hold most of its value as part of the sales process. For example, you don’t want to unload loads of inventory for 10% of its market value just to add more liquidity to your books.

In terms of investments, cash equivalents are normally considered to have short-term maturity rates of 90 days or less. Examples of cash equivalent investments include stocks and marketable securities, US Treasuries and bonds, mutual funds, money-market funds, exchange-traded funds (ETFs), accounts receivable, and inventory.

What qualifies as an illiquid asset?

Next, you’ve got non-liquid assets (or “illiquid assets”). Illiquid assets normally take the form of physical possessions that you can’t immediately turn into cash if needed. That’s because a lot of illiquid assets will take time and money to convert into liquid cash.

Examples of non-liquid assets include real estate, cars and trucks, jewelry, and collectibles.

Other types of illiquid assets you may have include funds in tax-advantaged accounts. These are often retirement funds like 401(k)s, 403(b)s, 529s, and individual retirement accounts (IRAs). These are considered non-liquid assets because, even though it’s often possible to withdraw money from these accounts, you’re going to have to pay penalties (and probably IRS taxes) on your withdrawals.

That makes withdrawing from tax-advantaged accounts cumbersome and expensive, which is why they don’t make the cash-equivalents list.

The same rule applies to real estate. If you own a rental property that you want to liquidate to pay for an imminent expense, turning that property into cash may not be as straightforward as you think it'll be. You’ll need to prep the property for sale, hire a real estate agent, pay for inspections, wait for nibbles, and then work through the escrow process and closing costs.

In a perfect world, you could achieve that in a few weeks — but most of us don’t live in a perfect world, and it could take months. More importantly, you may have to settle for less than market value for a quick sale if you really need the money. That’s why assets like real estate are considered long-term, non-liquid investments.

How do you invest in liquid assets?

If your financial portfolio is lacking in liquidity, don’t panic. Building liquid assets is typically pretty straightforward, and it works the same way as building your savings.

Building your liquid investments normally starts with cutting back on your expenses.

Sit down and look at where you can cut costs on your day-to-day spending because the money you can claw back from reducing your spending is what you’ll be able to use to save. It may help you to get a budget tracker app to help you look at where your income is disappearing. You’ll then be able to start a more rigid budget that you can realistically stick to.

Even the tiniest amounts that you can start regularly putting away into a savings account (or using to invest in cash equivalents) will make a huge difference in the long run.

You have plenty of options when it comes to the types of liquid assets you can invest in. Just make sure to do your research and understand what you’re actually looking for because some account types are more liquid than others.

Checking accounts

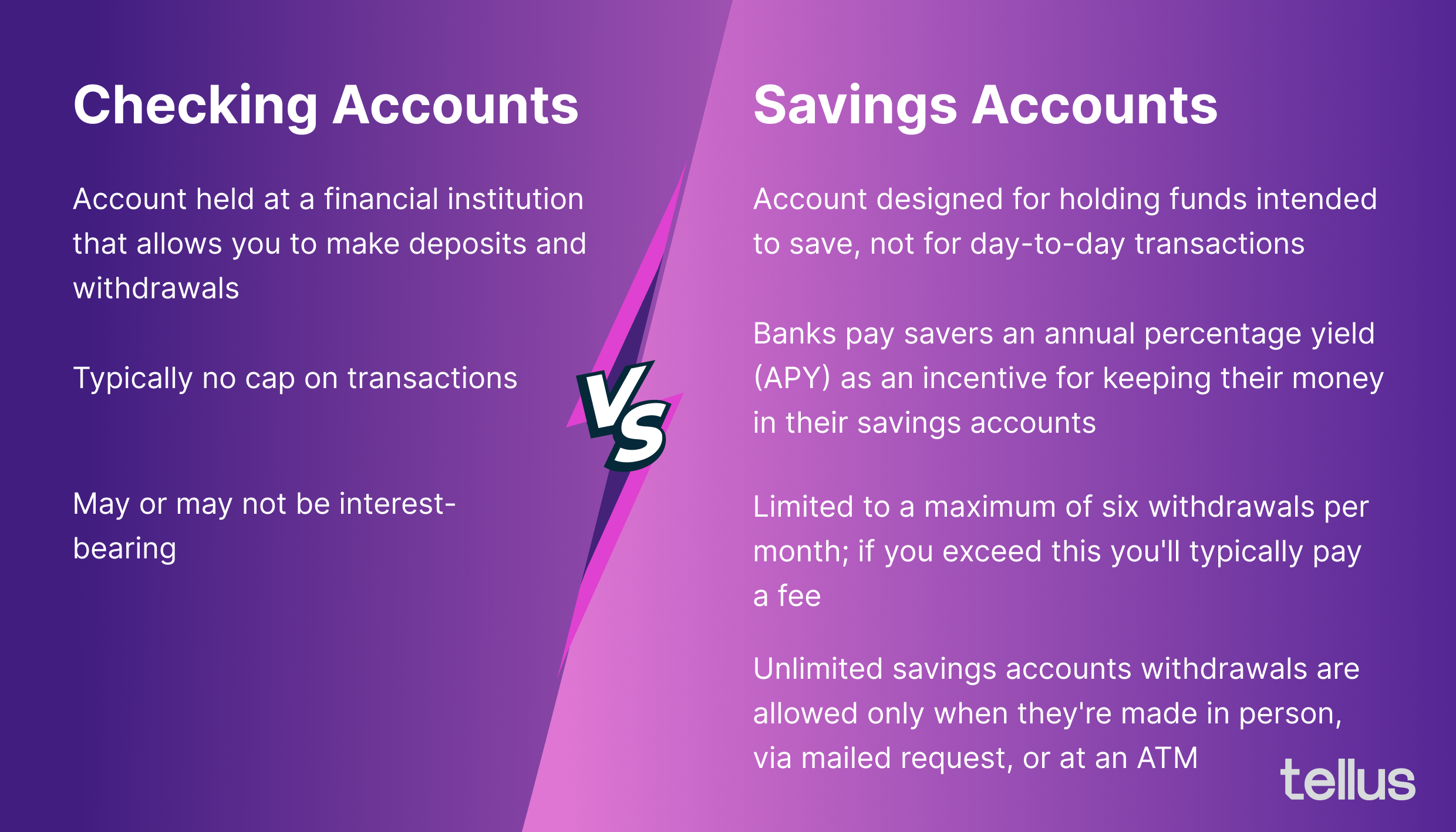

First, you’ve got checking accounts. These are the closest to cash where liquidity is concerned because you can make direct cash withdrawals or pay for things using your debit card. That’s about as liquid as it gets.

But just like any other asset account, remember that there are a few rules and fees to consider with checking accounts.

A lot of banks charge monthly or annual fees for maintaining your checking account. You may also be charged an overdraft fee if you try to clear a transaction worth more than your total account balance, or international transaction fees if you try to use your debit card while abroad.

Many checking accounts also have a minimum account balance. That means if your balance drops below a certain level or you don’t deposit enough in your account one month, you may need to pay a penalty fee.

Unfortunately, you can’t really operate without a checking account in 2022, so this stuff can’t be avoided. You just need to make sure you read the fine print and understand your account and how the fee structure works so that you don’t bump into any nasty surprises down the line if you have a lean month or need to use your account overseas.

Savings accounts

Next, you’ve got savings accounts.

By contrast, savings accounts are slightly less liquid because they’re designed to reward you for keeping your money in the bank. This is normally done by offering you regular interest payments based on your account balance or the amount you deposit each month. Federal rules limit the number of withdrawals you’re allowed to make from a savings account to ensure you aren't taking advantage of that system.

Savings accounts are also a smart choice because they’re secure. The FDIC insures all of your savings account deposits (up to $250,000), which means you won’t lose anything even if your bank goes out of business.

If you’re keen on taking advantage of a savings account that gives you more bang for your buck, it’s worth checking out a high-yield savings account.

High yield savings accounts

With a high yield savings account, you’re going to accumulate compound interest on your savings. That effectively means you earn interest on the interest payments you’ve already received.

For example, let’s say you deposit $10,000 into a high yield savings account that pays 1% compound interest on all of your deposits. That means you’d earn $100 worth of interest in year one.

But thanks to the power of compound interest, you’d earn even more in year two. Instead of paying you 1% worth of interest on your principal deposit, your savings account provider would then pay you 1% interest on your principal balance plus the interest you’ve already accumulated. That means you’d get $101 in interest.

At first glance, that doesn't sound like a huge improvement. But the more you deposit and the longer you save, that compound interest is going to add up. Better yet, it’s effectively “passive income” — which means you’re earning money without working for it. Not bad.

This passive income can help you build your liquid assets much quicker than you’d be doing with a standard savings account.

Money market accounts

Another type of liquid asset you could explore is a money market account (MMA).

This is another type of interest-bearing savings account where your cash is always accessible through the use of a debit card or check-writing privileges. But it’s worth noting money market accounts usually have large minimum deposit requirements and some restrictions on the transaction types you can use your account for.

Like savings accounts, federal rules also limit the number of withdrawals you’re allowed to make from a money market account. Most banks limit this to six withdrawals, but some may offer you a lower number per month.

Cash management accounts

Then, you’ve got cash management accounts.

These offer the liquidity benefits of an ordinary checking account with slightly higher interest rates. Cash management accounts don’t have the same rigid withdrawal rules on the number of times you can take cash out of your account. But some cash management accounts do have limits on the amount of money you can withdraw on a daily or monthly basis.

Another liquid investment option is a taxable investment account. These are asset accounts that you can set up through a stockbroker, and the accounts can hold securities like stock shares, bonds, ETFs, and mutual funds.

New to investment? Don’t worry because we’re happy to bust the jargon. ETFs are essentially a group (or “basket”) of securities that track an underlying market index. An ETF might include a range of stock shares and bonds — depending on the type of index your ETF is tracking.

Investment accounts

By contrast, a mutual fund is a pool of money that many investors will place cash into. A mutual fund manager will then use that money to buy stocks, bonds, and other securities that all of the fund’s investors then collectively own as a wider group.

Many investors opt for mutual funds because mutual funds offer you a fast and simple way to diversify your portfolio without having to take on a lot of risk by purchasing a huge range of securities.

They’re considered liquid investments because they are fairly easy to sell, and stock brokers will normally transfer the cash proceeds of a sale into your account within a few days.

But don’t forget that the stock market isn’t a sure thing — and if you end up having to sell ETF stocks in a big hurry, you may sell your security at a loss. Markets like this can be volatile, so there’s no such thing as a sure thing when it comes to investing in stocks.

Conclusion

At the end of the day, liquid assets are incredibly important to protect you and your family from financial hardship. You never know when life’s going to hit you out of the blue with a big expense — which is why you need to make sure you’re always prepared to pay for unexpected costs.

That’s where liquidity comes in. Liquid assets are the cash or cash equivalents you can rely on to help you deal with whatever life throws at you. But before you start building your portfolio and asset mix, it’s important that you understand how each asset operates and the most beneficial way to hold that asset.